Ensure your investment doesn't go to waste.

Comprehensive coverage pays if an act of nature damages or destroys your car.

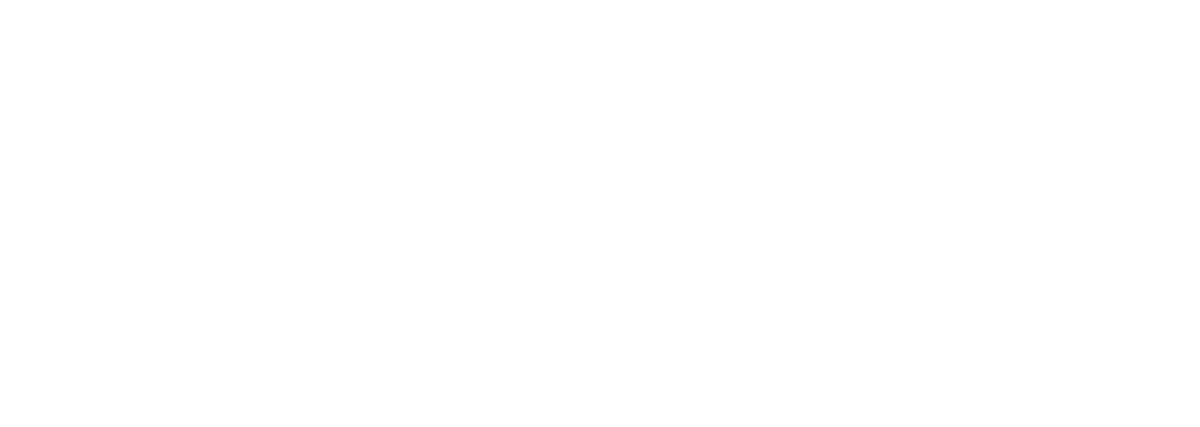

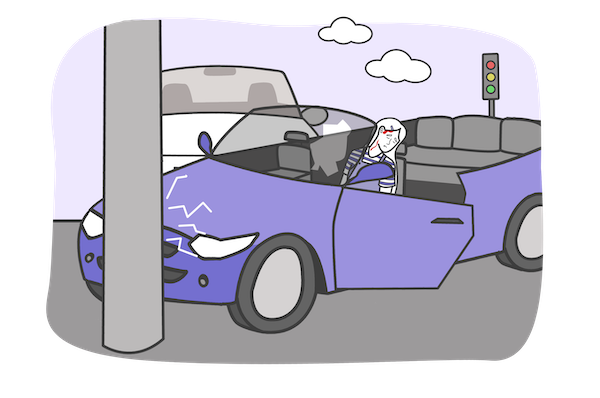

Comprehensive coverage pays if your car got into a collision with another vehicle.

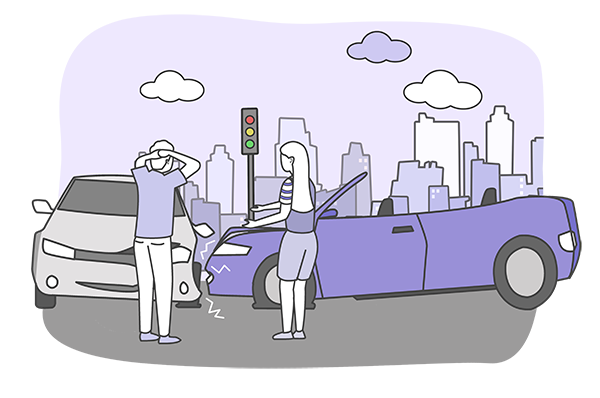

Comprehensive coverage pays if a property hits and damages your car like from falling objects.

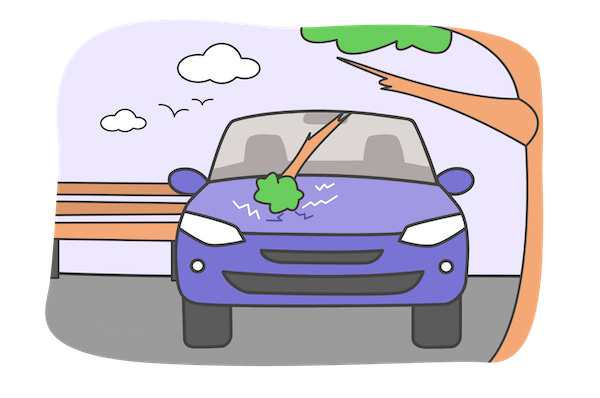

Comprehensive coverage pays if a person hits and damages your car.

Comprehensive coverage pays if someone inside your car is hurt during an accident.

Comprehensive coverage pays if someone vandalizes your car.

Comprehensive coverage pays if someone stole your car.

Comprehensive coverage pays for glass damages to your car.

Comprehensive coverage pays when your car damages someone else's property. For example their house or fence.

Getting insurance can be confusing, so we worked hard to make it simple. If you still have questions let us know,we are happy to help!

Motor vehicle insurance coverage that insures against damage to your vehicle. This includes fire, theft, and even accidental damage to your car.

Comprehensive auto policies last for a year. For example, if your policy’s start date is June 14, 2024, the comprehensive renewal due date would fall on June 14, 2025.

Acts of Nature (AON) is an optional benefit purchased with comprehensive coverage. It covers damages caused by fire, flood, and earthquakes. Acts of Nature coverage is usually required when the vehicle has a loan / mortgage.

Car insurance is designed to protect car owners from financial hardship that can result from the potentially expensive costs often associated with vehicular accidents. Without car insurance, the financial risk will rest on you, the car owner, in the event of an accident. Car insurance can mitigate some if not all of that risk.